03/02/24 - Jerome

The phenomenon of halving and its potential influence on price appreciation has long intrigued cryptocurrency enthusiasts. Understanding the mechanics of the halving is crucial for miners, especially when it leads to a reduction in the block reward. This article delves into the halving's implications, exploring shifts in price, hashrate, and miners' revenue from previous cycles.

Speculations abound on the possible outcomes of the next halving: will it precipitate a downturn in the mining industry, or will the effects be different? Let’s uncover what might lie ahead.

The Halving Defined

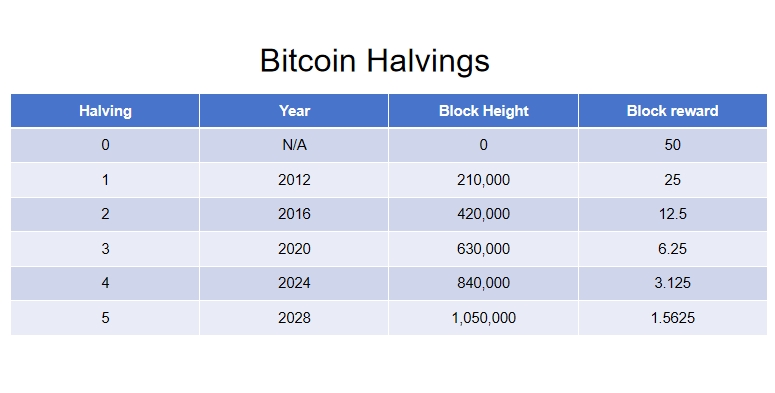

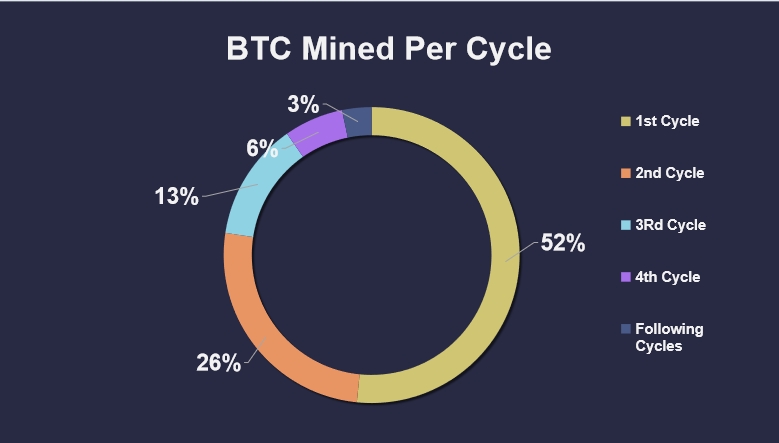

The Bitcoin halving is a scheduled event occurring every 210,000 blocks, which translates to roughly every four years. It marks a halving of the reward miners receive for adding new blocks to the blockchain. Starting at 50 BTC per block in 2009, subsequent halvings in 2012, 2016, and 2020 have reduced the reward to 6.25 BTC.

In total, there will be 32 halving events. After the last one, the issuance of new bitcoins will cease, with the cap reached at 21 million. From that point, miners will earn solely from transaction fees. The next halving, projected for late April 2024, is subject to the mining hashrate, which influences the timing of block production.

Projected Date for Next Halving: Late April 2024

Anticipation is building for the next Bitcoin halving, forecasted for late April 2024. This event's precise timing hinges on the block production rate, influenced by the total mining hashrate. An influx of miners could hasten the halving, underscoring the dynamic nature of the network.

Mining difficulty adjusts every 2,016 blocks to maintain consistent block intervals, which in turn, steadies halving schedules. As the event nears, predictions on its exact date gain accuracy, guided by halving countdown clocks.

Impact of Halving on Bitcoin's Price

The halving's impact on Bitcoin's market value is a subject of intense debate. Some posit that its effects are already priced in, with market actors adjusting in advance. Others suggest that the resulting supply cut, if met with steady or rising demand, might trigger a price upswing.

Historically, halvings have precipitated significant price rallies. For instance, after the 2020 halving, Bitcoin's price soared from around $8,600 to a peak of $68,000—a monumental 691% increase.

While price surges post-halving are common, they often exhibit a delay. After 2020's event, it took about 194 days for Bitcoin to reach a new high—a trend of diminishing time to peak with each halving.

Projections based on prior patterns suggest the April 2024 halving could catalyze the next bull market's zenith by late 2025.

Mining Revenue Implications

Hash price, a key profitability metric for miners, is expected to undergo a significant shift post-halving. Post-2020, it plunged by 54% due to the reward cut. Given the current trends, miners might face a dip to $43/PH/Day, demanding resilience through potentially lean months.

The historical propensity for Bitcoin's value to spike during halving cycles could, however, present lucrative prospects for those who persevere.

Five Unique Factors This Time Around

While history can guide us, there are unique factors at play this halving:

1. The demand for Bitcoin, propelled by the introduction of ETFs, could outstrip post-halving production, potentially driving up prices.

2. The resilience shown by mining companies during the bear market suggests fewer bankruptcies and a stable hashrate post-halving.

3. Miners might operate at a loss post-halving, betting on future price increases.

4. Miners' increased efficiency and strategic operations, such as low-power modes, could sustain profitability.

5. The potential for high transaction fees immediately after the halving might incentivize additional hashrate despite losses.

The combined factors imply that the dynamics around the forthcoming halving could deviate from those seen in prior cycles.

JSBIT stands ready to support miners through these transformative times. With our extensive expertise in ASIC mining hardware and a commitment to service excellence, we provide both new and seasoned miners with the tools and insights needed to navigate the post-halving landscape. Our array of top-tier ASIC miners and customer-centric approach positions us to be a key ally for miners aiming to capitalize on the post-halving surge.

Looking ahead, the partnership with JSBIT isn't just about enduring the halving event; it's about thriving in its wake. We invite miners to join us on this journey, leveraging our premium equipment and services to unlock their full mining potential. With JSBIT, miners are not just preparing for the next halving—they are setting the foundation for sustained success in the blockchain mining revolution.

Post time: Mar-04-2024